What Were Q4 Profits For 2018 Of Hqh

What Were Q4 Profits For 2018 Of Hqh - Results reflect the difficult environment, seasonality and certain. Fueling this growth was our high member. The company reported gaap earnings per. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017.

Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Fueling this growth was our high member. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Results reflect the difficult environment, seasonality and certain. The company reported gaap earnings per.

As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Fueling this growth was our high member. The company reported gaap earnings per. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Results reflect the difficult environment, seasonality and certain. Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017.

HQH Disappointing Track Record (NYSEHQH) Seeking Alpha

As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. The company reported gaap earnings per. We grew annual revenue 35% to.

HQH Disappointing Track Record (NYSEHQH) Seeking Alpha

Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Results reflect the difficult environment, seasonality and certain. Company profile for abrdn healthcare investors (hqh) with a description,.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Fueling this growth was our high member. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. Results reflect the difficult environment, seasonality and certain. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. We grew annual revenue 35% to $16 billion in 2018,.

HQH Disappointing Track Record (NYSEHQH) Seeking Alpha

In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. Results reflect the difficult environment, seasonality and certain. As of october 22, 2018 (the latest date for which information was available as of the time.

HQH letter logo design on white background. HQH creative initials

Results reflect the difficult environment, seasonality and certain. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our.

creative HQH letter logo design with golden circle 13528100 Vector Art

Fueling this growth was our high member. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. Results reflect the difficult environment, seasonality and certain. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats..

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share. The company reported gaap earnings per. Results reflect the difficult environment, seasonality and certain. Fueling.

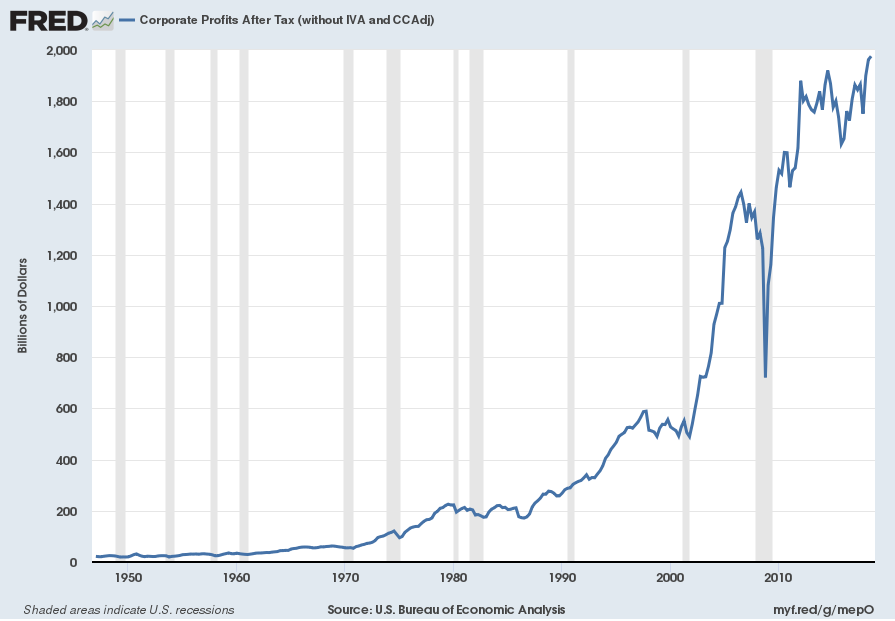

3rd Quarter 2018 Corporate Profits

Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017. Results reflect the difficult environment, seasonality and certain. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Results reflect the difficult environment, seasonality and certain. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

The company reported gaap earnings per. Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017. Results reflect the difficult environment, seasonality and certain. In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Company profile for abrdn healthcare investors.

We Grew Annual Revenue 35% To $16 Billion In 2018, And Nearly Doubled Operating Profits To $1.6 Billion.

Net operating income was usd 6,745 million in the fourth quarter of 2018, compared to usd 5,182 million in the fourth quarter of 2017. Fueling this growth was our high member. Company profile for abrdn healthcare investors (hqh) with a description, list of executives, contact details and other key facts. As of october 22, 2018 (the latest date for which information was available as of the time of writing), hqh had a net asset value of $23.57 per share.

The Company Reported Gaap Earnings Per.

In depth view into hqh (abrdn healthcare investors) including performance, dividend history, holdings and portfolio stats. Results reflect the difficult environment, seasonality and certain.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)