What Is Hpa Borrower

What Is Hpa Borrower - The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). The law requires that lenders must inform borrowers of. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. In some instances, homeowners have experienced problems in canceling pmi.

The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law requires that lenders must inform borrowers of. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. In some instances, homeowners have experienced problems in canceling pmi.

It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. In some instances, homeowners have experienced problems in canceling pmi. The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). The law requires that lenders must inform borrowers of.

HPAFaip Advanced solutions for the automotive industry

In some instances, homeowners have experienced problems in canceling pmi. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. The homeowners protection act.

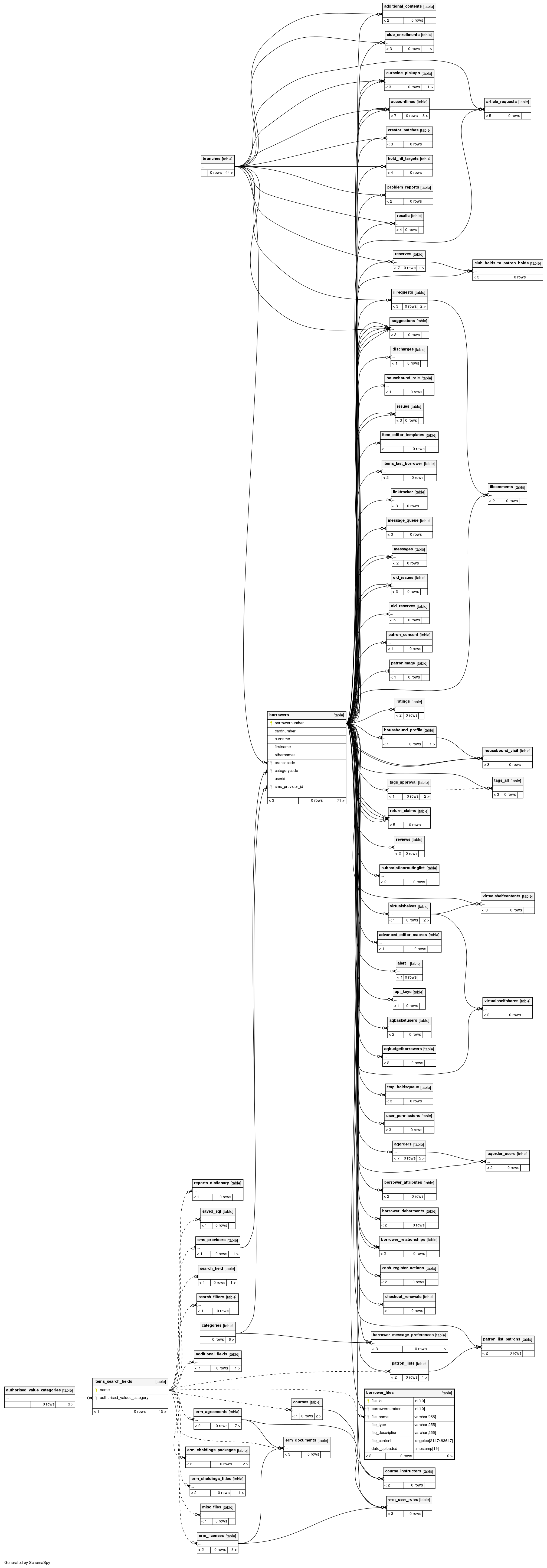

borrower_files Database

The law requires that lenders must inform borrowers of. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). At other times,.

HPA4.5 Studioman

The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). In some instances, homeowners have experienced problems in canceling pmi. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law.

Borrower Definition Explained with RealLife Exaples

At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. In some instances, homeowners have experienced problems in canceling pmi. The homeowners protection act.

Stop Bad Loans! Master the Art of Borrower Assessment

The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law requires that lenders must inform borrowers of. In some instances,.

HPA triangle letter logo design with triangle shape. HPA triangle logo

At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. In some instances, homeowners have experienced problems in canceling pmi. The law requires that lenders must inform borrowers of. The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements.

About us Borrower Defense Law

It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law requires that lenders must inform borrowers of. In some instances, homeowners have.

HPA Adapt Atlantis Medical Wellness & Weight Loss

It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. The homeowners protection act (hpa) was passed in 1998 to address abuse of and confusion regarding homeowners’ requirements to pay for private mortgage insurance (pmi). At other times, lenders may have agreed to terminate coverage when the.

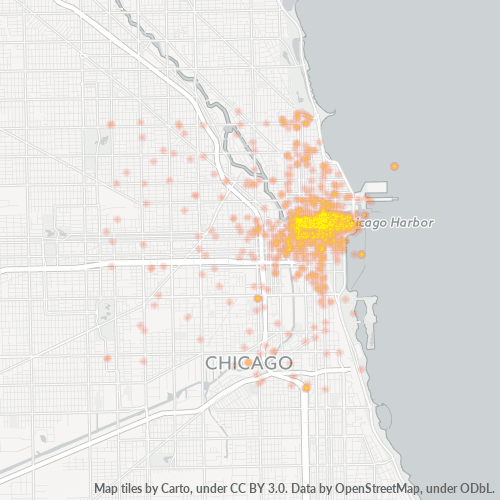

HPA Borrower 20181 MS LLC Chicago Rodman Ward III

At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law requires that lenders must inform borrowers of. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. The homeowners protection act (hpa).

Mahalo for 45 Years Join HPA Today! Hawaii Paralegal Association

The law requires that lenders must inform borrowers of. It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The homeowners protection act (hpa).

The Homeowners Protection Act (Hpa) Was Passed In 1998 To Address Abuse Of And Confusion Regarding Homeowners’ Requirements To Pay For Private Mortgage Insurance (Pmi).

It allows prospective buyers who cannot, or choose not to, make a significant down payment to obtain mortgage financing at an affordable rate. In some instances, homeowners have experienced problems in canceling pmi. At other times, lenders may have agreed to terminate coverage when the borrower’s equity reached 20 percent, but the policies and procedures used. The law requires that lenders must inform borrowers of.