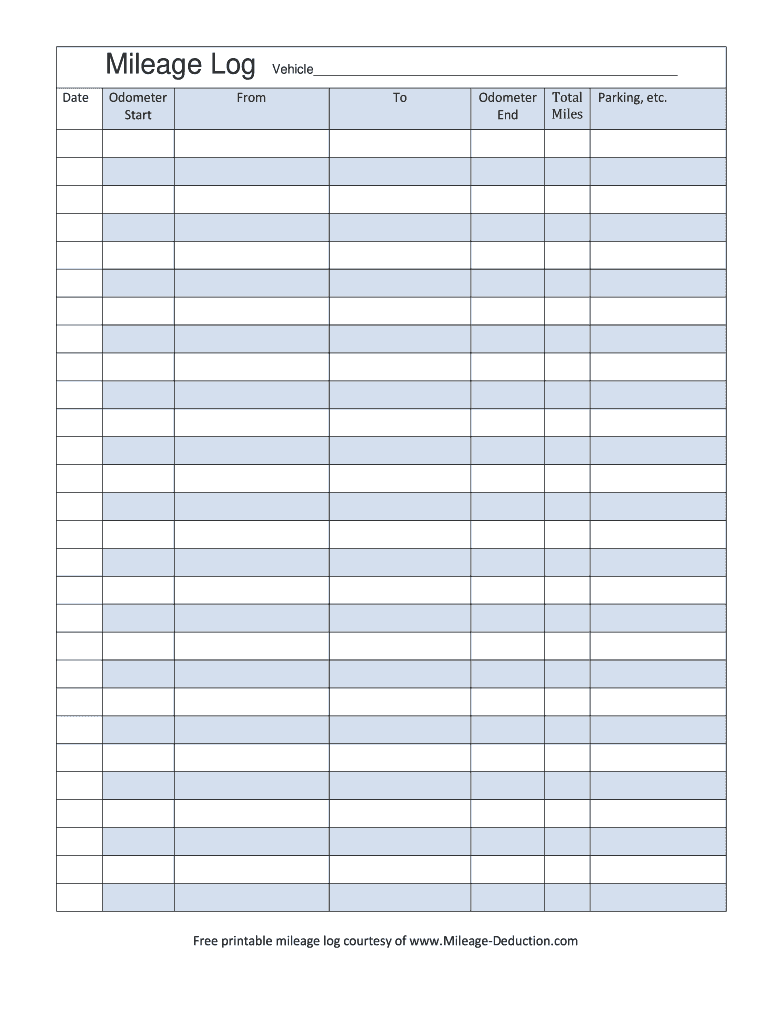

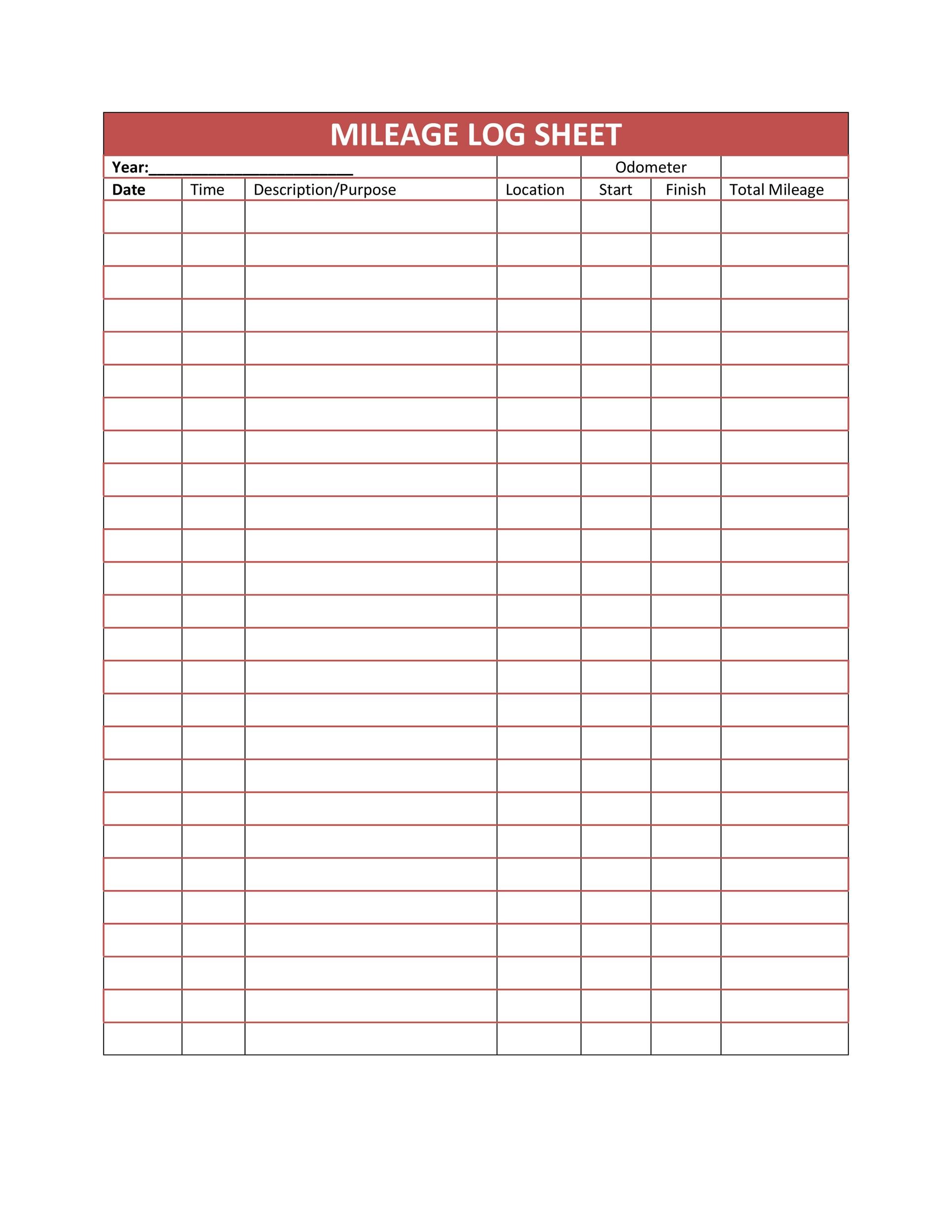

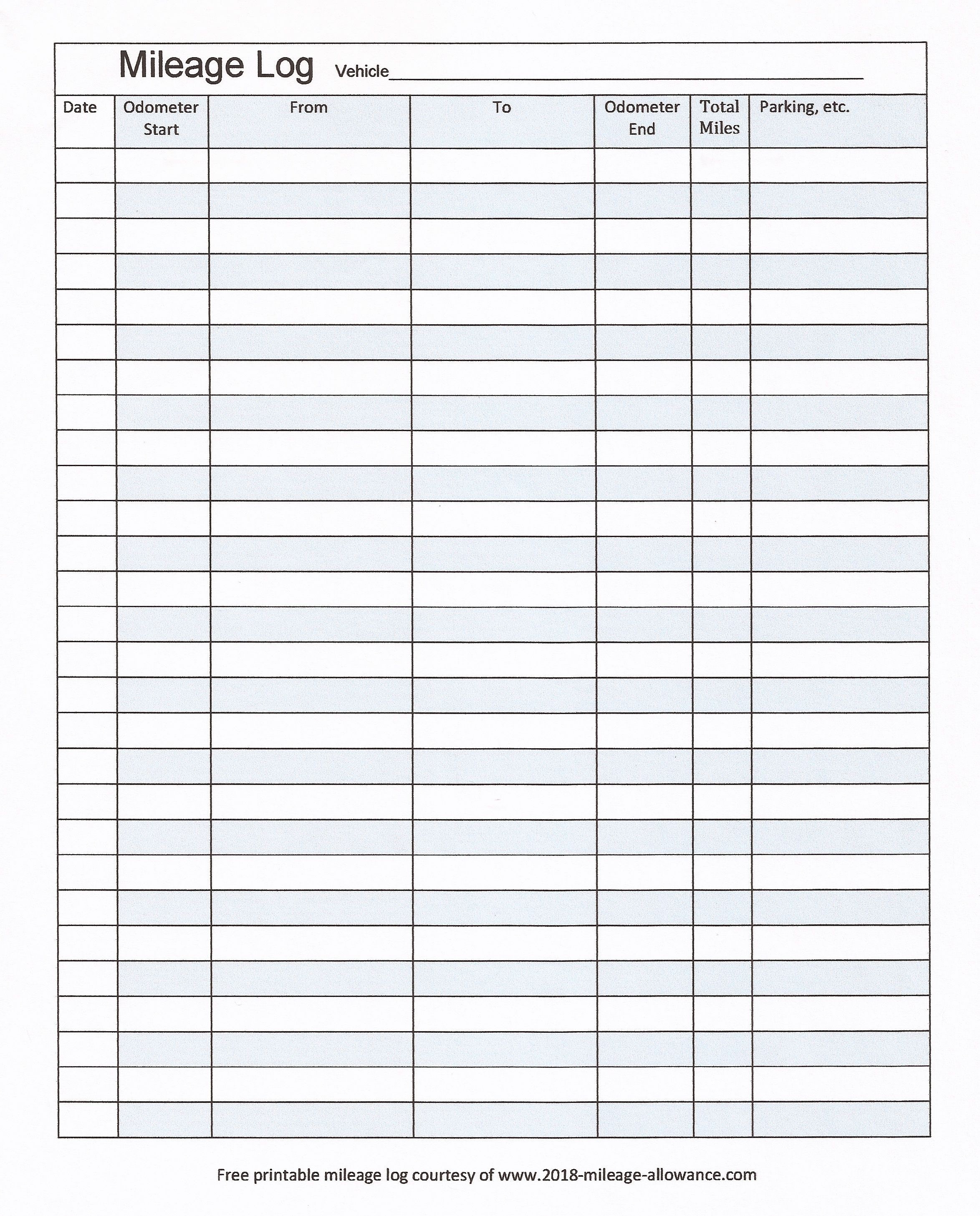

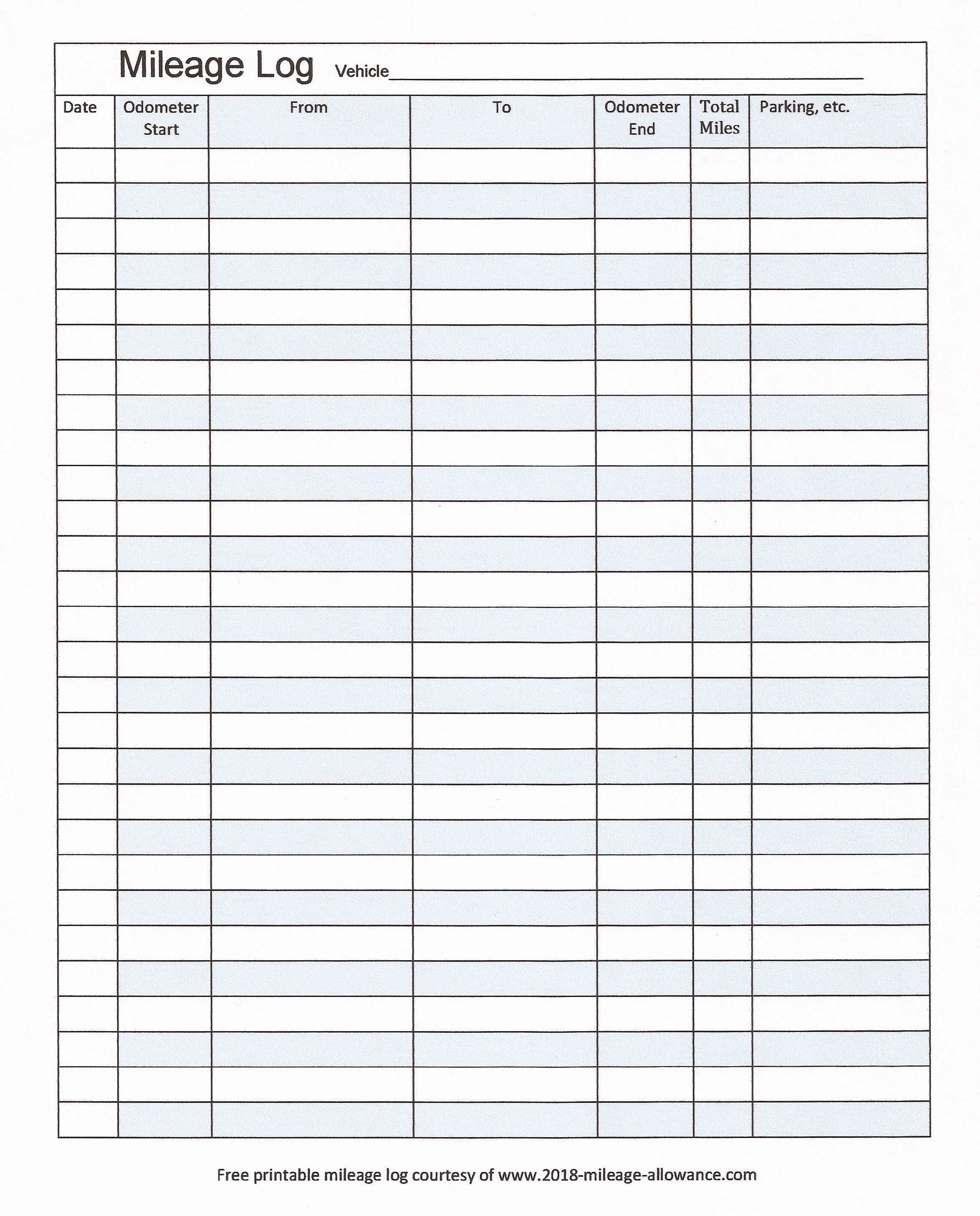

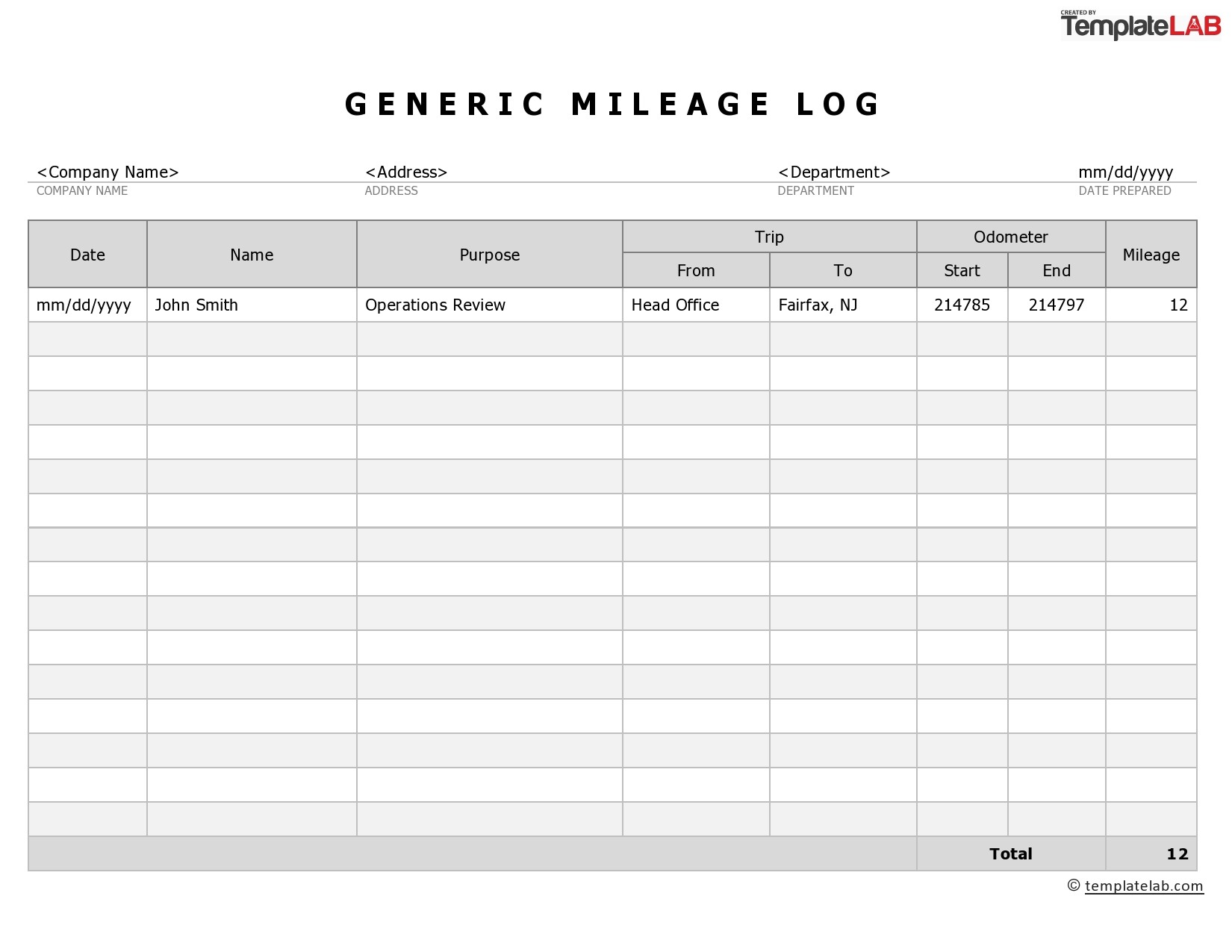

Irs Approved Mileage Log Printable

Irs Approved Mileage Log Printable - I'm not sure how this works as i use a third party's program but the phrase excess mileage appears in box 1.15 on the employment supplement. This box relates to payments above. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I must apologise for the delay in replying. Using your figures that would be £1071.45. However you can only claim tax relief on the difference between what your employer paid and what your approved mileage allowance works out at. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with.

However you can only claim tax relief on the difference between what your employer paid and what your approved mileage allowance works out at. I'm not sure how this works as i use a third party's program but the phrase excess mileage appears in box 1.15 on the employment supplement. Using your figures that would be £1071.45. I must apologise for the delay in replying. This box relates to payments above. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with.

I must apologise for the delay in replying. This box relates to payments above. Using your figures that would be £1071.45. However you can only claim tax relief on the difference between what your employer paid and what your approved mileage allowance works out at. I'm not sure how this works as i use a third party's program but the phrase excess mileage appears in box 1.15 on the employment supplement. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to.

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

I'm not sure how this works as i use a third party's program but the phrase excess mileage appears in box 1.15 on the employment supplement. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled.

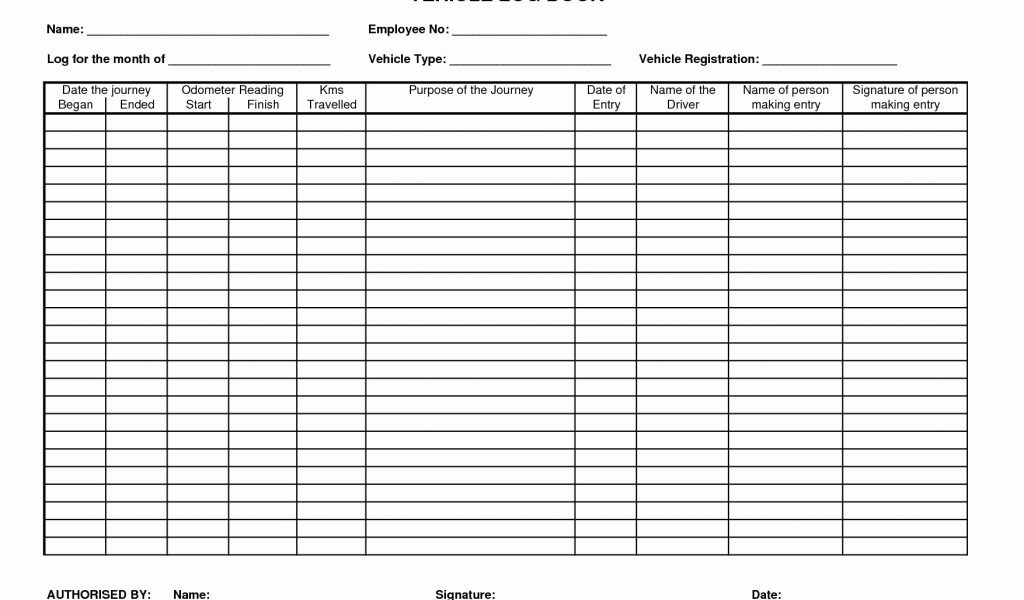

Printable Mileage Log FREE DOWNLOAD Aashe

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does).

Mileage Template Unique Mileage Log If You Re Somebody Who Needs To

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does).

Mileage Tracker Sheet 25 Printable IRS Mileage Tracking Templates

I must apologise for the delay in replying. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per.

Free Printable Mileage Log Free Printable A to Z

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. However you can only claim tax relief on the difference between what your employer paid and what your approved mileage allowance works out at. Using.

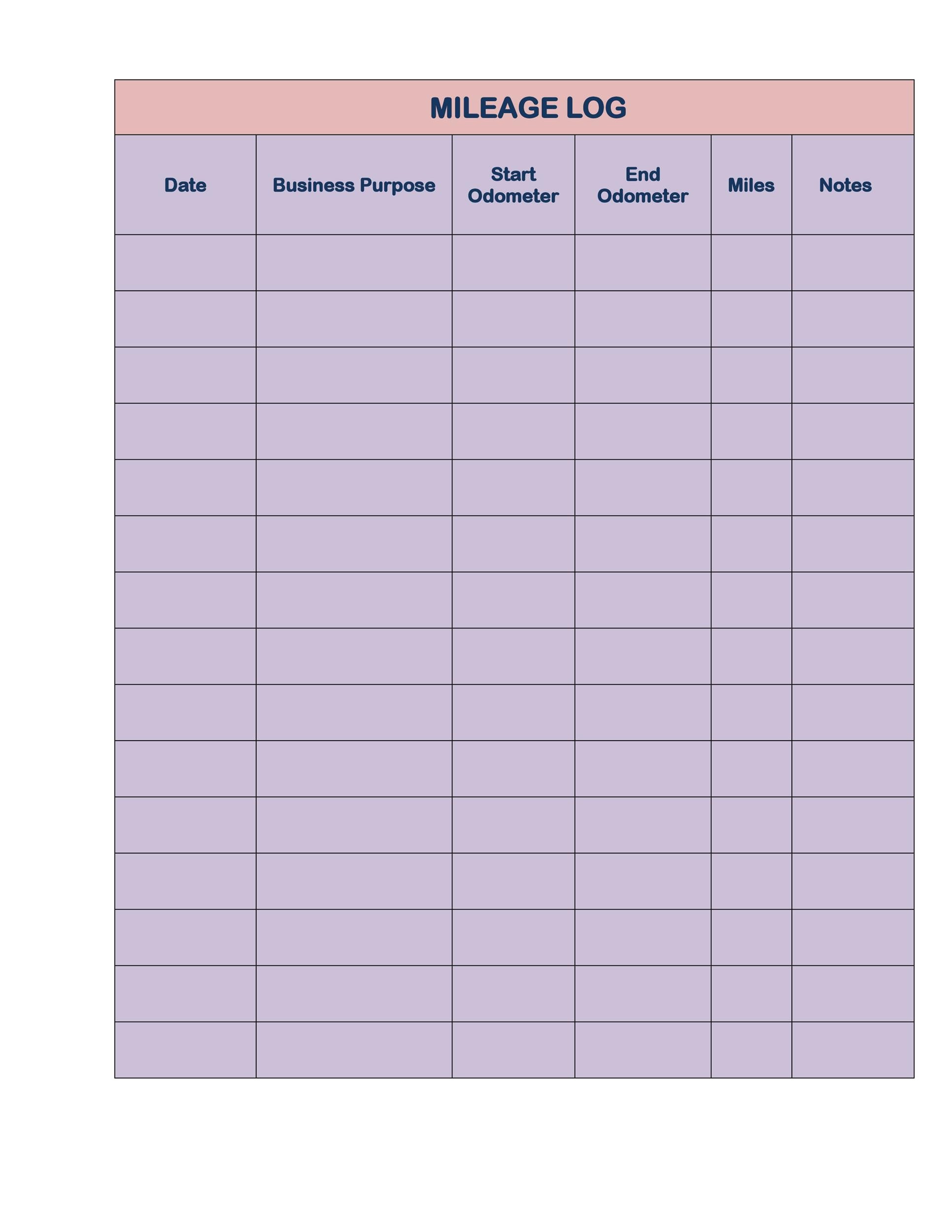

Irs Approved Mileage Log Printable

I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates.

The Best printable mileage log Derrick Website

This box relates to payments above. I must apologise for the delay in replying. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with. Using your figures that would be £1071.45. I'm not sure how.

Irs Approved Mileage Log Printable

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does).

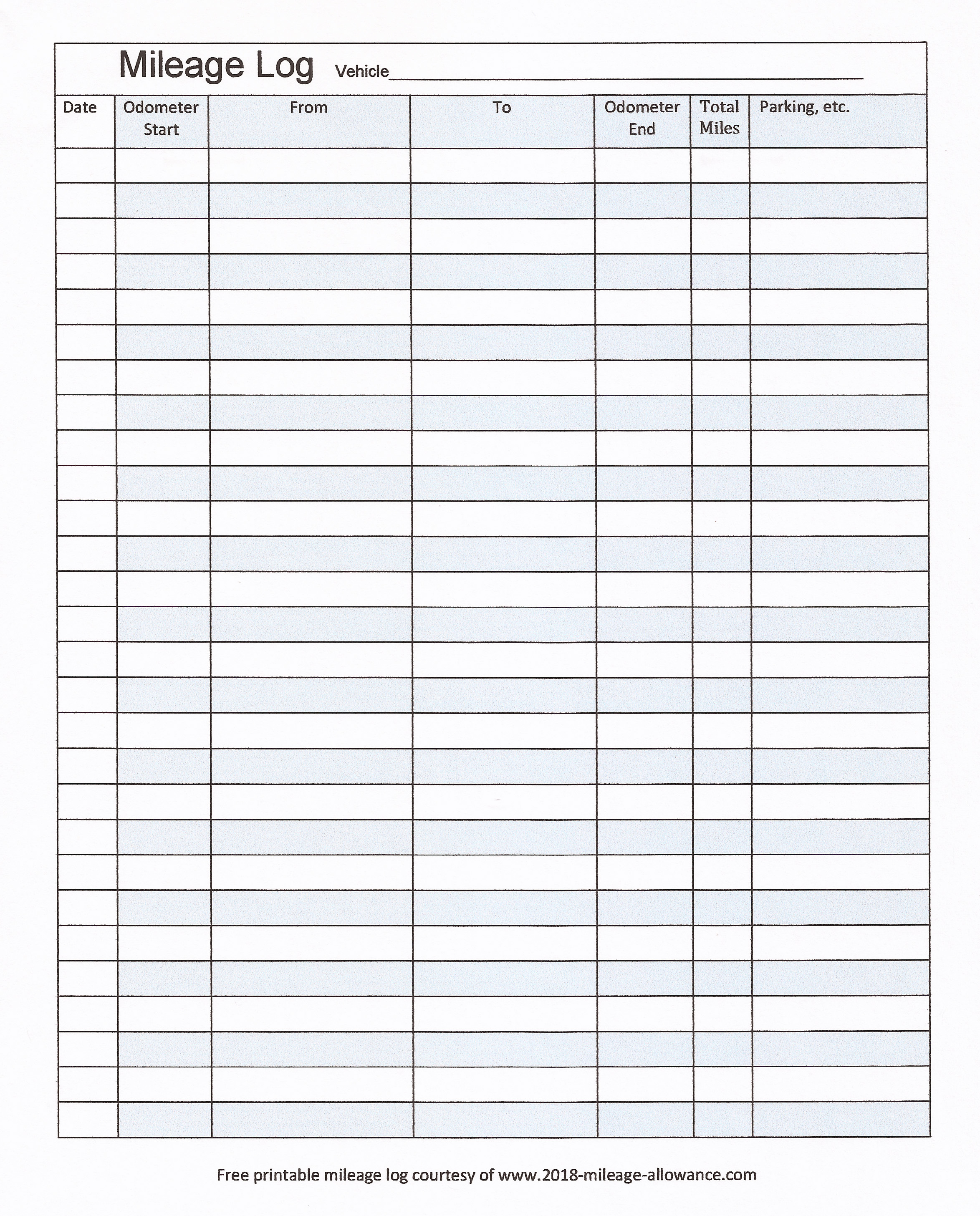

Mileage Spreadsheet For Irs inside Form Templates Mileage Spreadsheet

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does).

Irs Approved Mileage Log Printable

The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. Using your figures that would be £1071.45. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile.

I Must Apologise For The Delay In Replying.

Using your figures that would be £1071.45. This box relates to payments above. The size of the car allowance is irrelevant, it is no different to extra salary as it is taxed in full as the employer calculates business use at 20ppm then the employee is entitled to. I've been claiming business mileage for over 20 years now at the hmrc rate of £0.45 per mile and wanted to know (if anyone does) why the amount hasn't changed for decades & inline with.

I'm Not Sure How This Works As I Use A Third Party's Program But The Phrase Excess Mileage Appears In Box 1.15 On The Employment Supplement.

However you can only claim tax relief on the difference between what your employer paid and what your approved mileage allowance works out at.