Inter Brn Cash Chg Incl Gst Meaning

Inter Brn Cash Chg Incl Gst Meaning - You need to register with the bank for availing these services. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. Cash beyond above limits can be offered.

Cash beyond above limits can be offered. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. You need to register with the bank for availing these services. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019.

The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. Cash beyond above limits can be offered. You need to register with the bank for availing these services. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above.

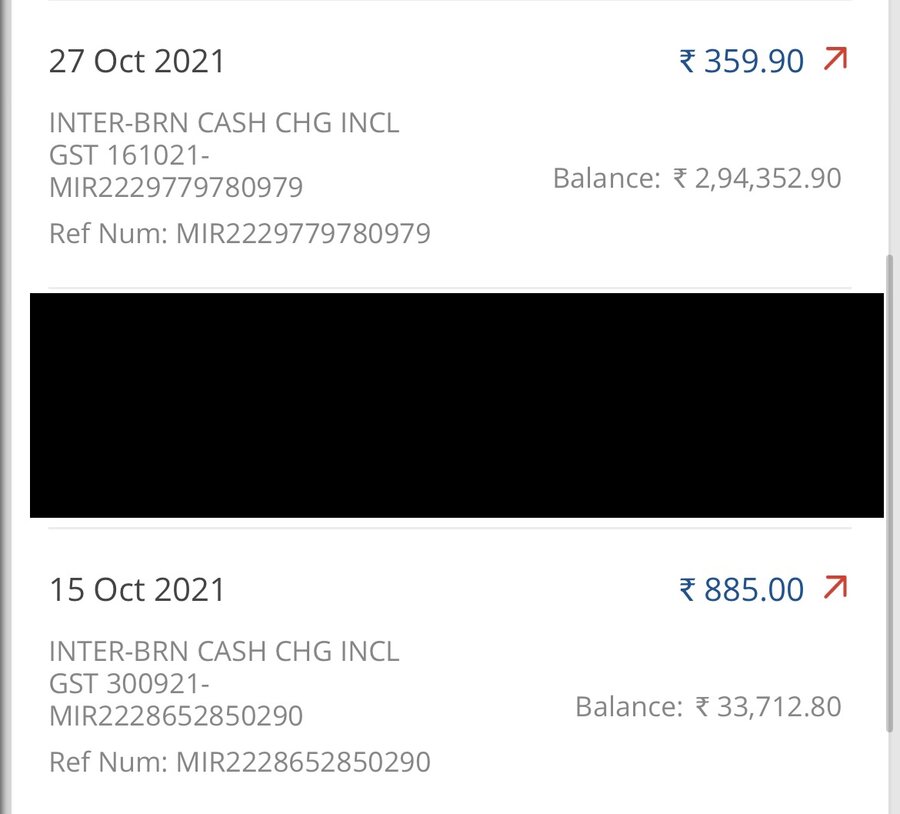

[Resolved] HDFC Bank — complain about brn cash txn chgs incl gst charge

You need to register with the bank for availing these services. Cash beyond above limits can be offered. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019.

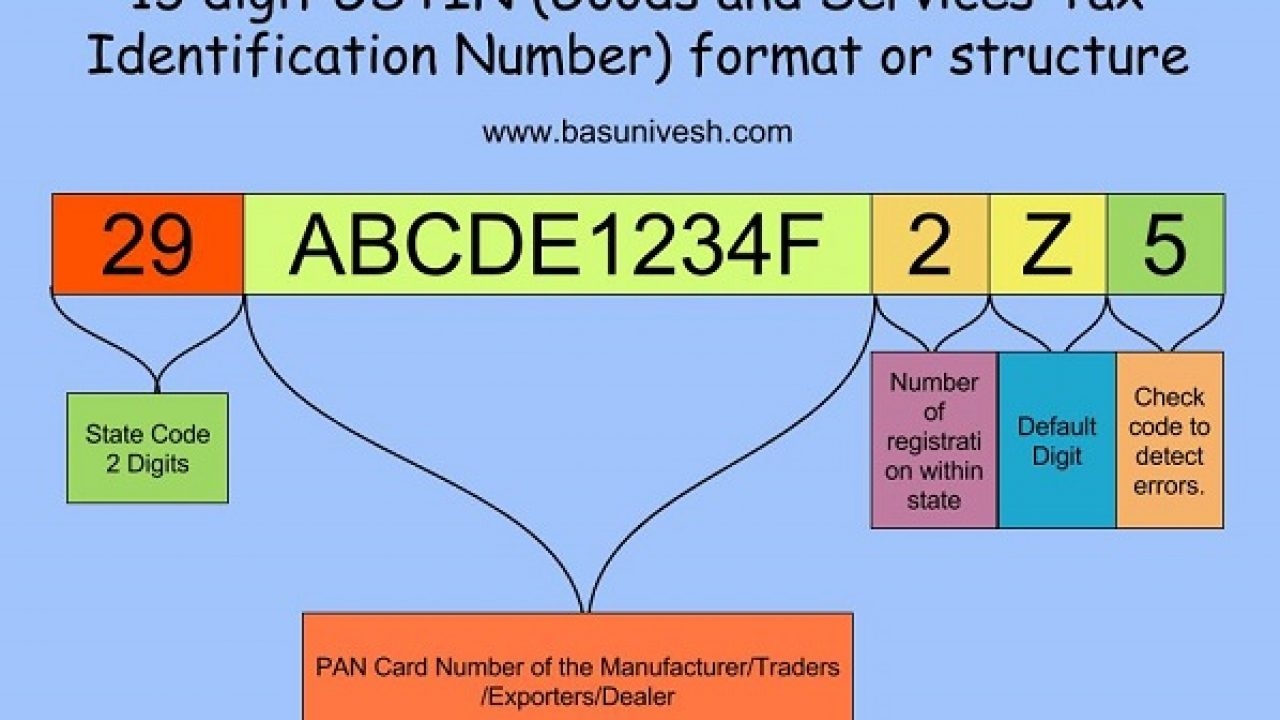

Goods and Services Tax (GST) meaning an overview Tutor's Tips

Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. You need to register with the bank for availing these services. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above.

HDFC Bank — Complain about inter brn cash txn chgs incl gst charge

All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. You need to register with the bank for availing these services. Cash beyond above limits can be offered.

Gst Meaning With Example * Invoice Template Ideas

Cash beyond above limits can be offered. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. You need to register with the bank for availing these services. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019.

Brn Cash Txn Chgs Incl Gst — Hdfc

You need to register with the bank for availing these services. Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above.

HDFC Bank — Interbrn cash chg incl gst

All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. You need to register with the bank for availing these services.

HDFC Bank — Inter branch cash chg incl GST.

The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. You need to register with the bank for availing these services. Cash beyond above limits can be offered.

[Resolved] HDFC Bank — Deduction of Rs 177 for (\"BRN Cash txn chgs

The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. You need to register with the bank for availing these services. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. Cash beyond above limits can be offered.

[Resolved] HDFC Bank — amount deducted in the name of interbrn cash

Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. You need to register with the bank for availing these services.

Gst Meaning With Example * Invoice Template Ideas

All foreign exchange transactions are subject to levy of goods and services tax (gst), which is payable in addition to the charges mentioned above. You need to register with the bank for availing these services. Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019.

All Foreign Exchange Transactions Are Subject To Levy Of Goods And Services Tax (Gst), Which Is Payable In Addition To The Charges Mentioned Above.

Cash beyond above limits can be offered. The said charge is interbranch cash transaction charge levied against the transaction done on september 26, 2019. You need to register with the bank for availing these services.

![[Resolved] HDFC Bank — complain about brn cash txn chgs incl gst charge](https://www.consumercomplaints.in/thumb.php?complaints=2217537&comment=4044446&src=16618656056961.jpg&wmax=900&hmax=900&quality=85&nocrop=1)

![[Resolved] HDFC Bank — Deduction of Rs 177 for (\"BRN Cash txn chgs](https://www.consumercomplaints.in/thumb.php?complaints=2856567&src=379007794.jpg&wmax=900&hmax=900&quality=85&nocrop=1)

![[Resolved] HDFC Bank — amount deducted in the name of interbrn cash](https://www.consumercomplaints.in/thumb.php?complaints=2323567&src=684353343.png&wmax=900&hmax=900&quality=85&nocrop=1)